Annuity factor calculator

FERS employees will be able to use the Projected Annuity Calculator spreadsheet even though it was originally designed for CSRS retirements. Using an interest rate i the capital recovery factor is.

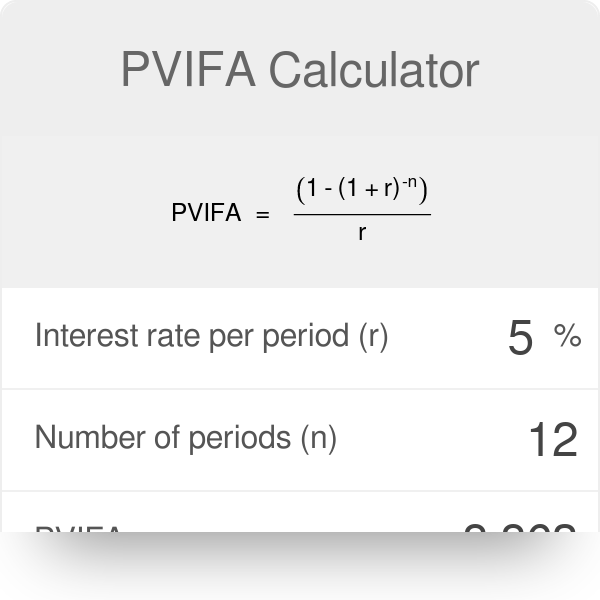

Present Value Annuity Factor Formula With Calculator

To get the best result from an annuity calculator it helps to know the average annuity rates for the type of annuity you plan to buy.

. The economic climate of 2022 has made annuities more attractive than ever for consumers looking to maximize their retirement savings. The present value is given in actuarial notation by. This is the present value per dollar received per year for 5 years at 5.

Present Value Of An Annuity. This is related to the annuity formula which gives the present value in terms of the annuity the interest rate and the number of annuities. In this case each cash flow grows by a factor of 1g.

But you can add a specific guarantee period that ensures the annuity income continues for a period of time even if you die. Annuity Due Payment - Future Value FV Calculator. An annuity is a contract with an insurance company that promises to pay the buyer a steady stream of income in the future such as after retirement.

The present value of an annuity is the current value of a set of cash flows in the future given a specified rate of return or discount rate. Present value is linear in the amount of payments therefore the present. Similar to the formula for an annuity the present value of a growing annuity PVGA uses the same variables with the addition of g as the rate of growth of the annuity A is the annuity payment in the first period.

The best age at which to get an annuity depends on a number of factors including a persons current circumstances and investments risk tolerance longevity prospects and expected income needs. Judiths SCD for retirement is Nov. Ordinary Annuity P 1 1 r-n 1 r t r The annuity due formula can be explained as follows.

5000 then it is better for Company Z to take money after two years otherwise take Rs. Use this calculator to determine your allowable 72tq Distribution and how it maybe able to help fund your early retirement. Guaranteed periods from zero to over 40 years are available.

5500 after two years we need to calculate a present value of Rs. 1 33 days 1 month and 3 days with 1 month carried over to the month column. Please note that your financial institution may or may not.

The evolution per each period is presented below. Whether Company Z should take Rs. Where is the number of terms and is the per period interest rate.

Future versions of this calculator will allow for different interest frequency. It is assumed that all bonds pay interest semi-annually. The FERS basic annuity formula is actually pretty simple and is based on your salary and years of service.

This is a calculation that is rarely provided for on financial calculators. Finally the ordinary annuity formula can be expressed on the basis of the annuity payment step 1 no. Your gender is a key factor in determining your life expectancy which annuity carriers use to calculate your income benefits from an immediate annuity.

The Society of Actuaries SOA developed the Annuity Factor Calculator to calculate an annuity factor using user-selected annuity forms mortality tables and projection scales commonly used for defined benefit pension plans in the United States or Canada. Most annuity purchasers use guarantee periods to guard against the risk of dying soon after purchasing the annuity. And if you retire at age 62 or older with 20 years of service you get a slight bonus 11 multiplier vs.

For example an individual is wanting to calculate the present value of a series of 500 annual payments for 5 years based on a 5 rate. The most important factor that should be considered here is the overall risk Vs. The crediting formulas of indexed annuities generally have some type of limiting factor that is intended to cause interest earnings to be based only on a portion of the change in whatever index it is tied to.

Her length of service for computing her FERS basic annuity is computed using the above chart. Life annuity incomes are guaranteed for life. The leftover 3 days are forfeited.

There are several variables that go into calculating. 5500 is higher than Rs. Of periodic payments step 2 a period of delay step 3 and rate of interest step 4 as shown below.

CRF i1 in 1 in-1 where n is the number of annuities received. FERS BASIC BENEFIT CALCULATION. 5000 today or Rs.

Annuity Payment - Future Value FV Calculator. Present Value of Annuity PV is estimated by taking account of the annuity type. The Annuity Calculator is intended for use involving the accumulation phase of an annuity and shows growth based on regular deposits.

Period Starting balance Payment Interest Ending Balance. Ð lç D¼â øJÿiN 4L¹9ËÚQ¾YhÙ A gvz ÆÓÀƒ Degœ µ Þо ÙEÅfv óÐ õ2 ð 3G VqC9ð Ðk. The present value of an annuity is the value of a stream of payments discounted by the interest rate to account for the fact that payments are being made at various moments in the future.

The purpose of this calculator is to provide calculations and details for bond valuation problems. If n 1 the CRF reduces to 1 i. FERS Basic Annuity High-3 Salary x Years of Service x 1.

Annuity calculator - Calculate the annuity value of different types of annuities such as immediate annuity deferred annuity fixed annuity etc. 2 For purposes of FERS annuity computation 31 years and 9 months is used. Annuity Due Payment - Present Value PV Calculator.

Just enter your. An annuity is a contractual financial product sold by financial institutions that is designed to accept and grow funds from an individual and then upon annuitization pay out a stream. 2021 saw the highest annuity sales since 2008 with experts citing the financial turmoil caused by the COVID-19 pandemic as a major factor in the record-breaking sales.

FVIFA is the abbreviation of the future value interest factor of an annuity. This tool is designed to calculate relatively simple annuity factors for users who are accustomed to making actuarial. The future cash flows of.

Please consult a qualified professional when making decisions about your personal finances. 5000 if the present value of Rs. Mutual funds RDs etc.

By looking at a present value annuity factor table the annuity factor for 5 years and 5 rate is 43295. The IRS rules regarding 72tq Distributions are complex. It is a factor that can be used to calculate the future value of a series of annuities.

The algorithm behind this future value of annuity calculator applies the equations detailed here. 5500 on the current interest rate and then compare it with Rs. If you retire at age 62 or later with at least 20 years of service a factor of 11 is used rather than 1.

FERS employees projected annuity without survivor benefits will be the same. Now in order to understand which of either deal is better ie.

Annuity Formula Present Future Value Ordinary Due Annuities Efm

Present Value Annuity Table Formulas Calculator Basic Accounting Help

Earned And Unearned Income For Calculating The Eic Usa Earnings Income Annuity

Pv Annuity Calculator Discount 53 Off Www Ingeniovirtual Com

Annuity Payment Factor Pv Formula With Calculator

Annuity Formula What Is Annuity Formula Examples

Fers Retirement Calculator 6 Simple Steps To Estimate Your Federal Pension Retirement Calculator Federal Retirement Retirement

Pvifa Calculator

Future Value Annuity Due Tables Double Entry Bookkeeping Time Value Of Money Annuity Table Annuity

Annuity Factor Calculator Youtube

Present Value Of A Growing Annuity Formula With Calculator

Future Value Of Annuity Formula With Calculator

Get Help Computing The Primefactorization For Any Given Positive Integer Number With The Factoring Calculator Math Calculator Calculator Prime Factorization

Present Value Of An Annuity How To Calculate Examples

Pv Annuity Calculator Flash Sales 54 Off Www Ingeniovirtual Com

Pv Annuity Calculator Discount 53 Off Www Ingeniovirtual Com

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping